As digital transformation continues to present opportunities and change the way we work (gig economy, remote workers, etc.) business processes increasingly involve multiple, loosely-coupled stakeholders needing to share information via the cloud. Sharing information involves sharing files and without a solid approach and an industry-leading collaboration platform, securely sharing files and delivering information to partners when needed can be challenging.

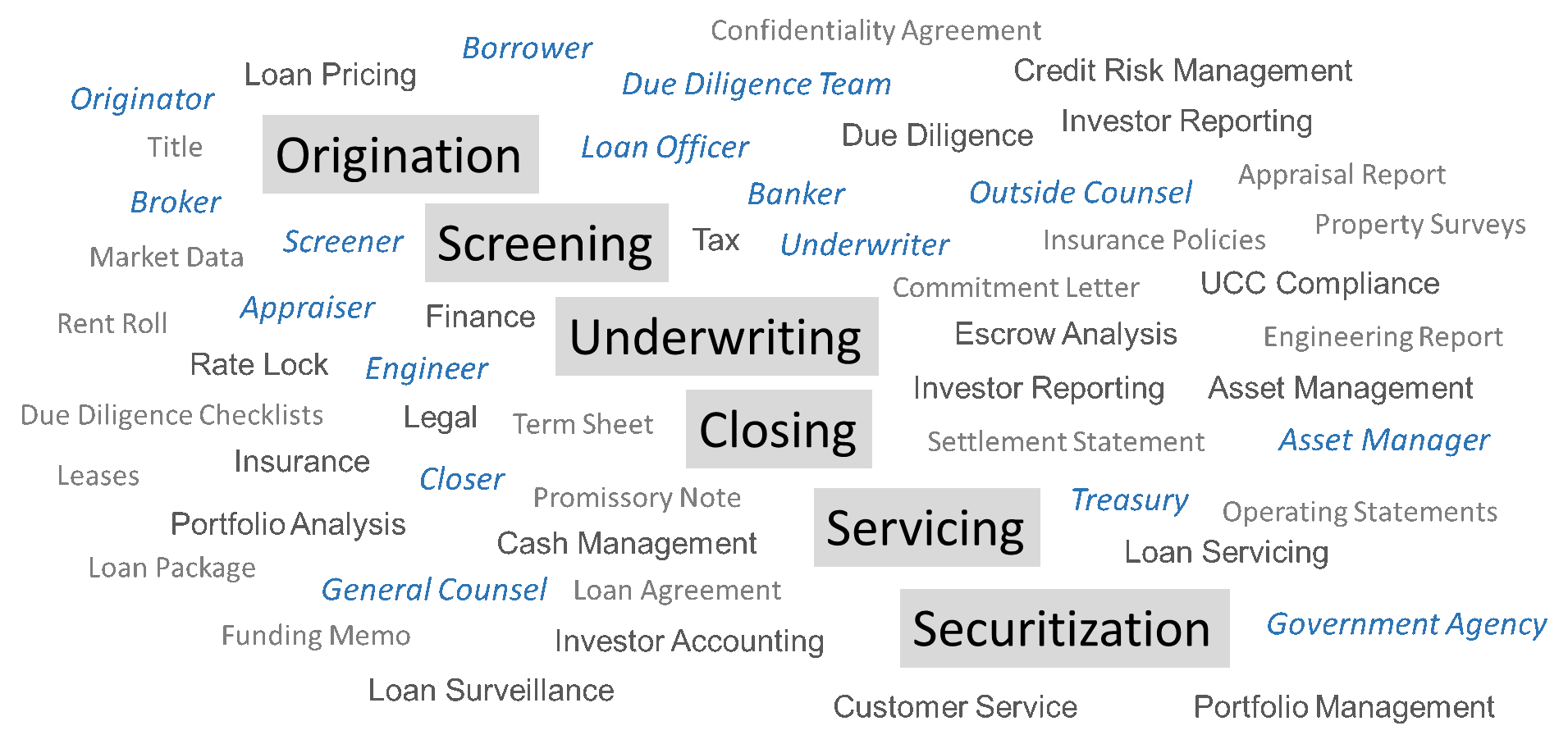

These challenges are not unfamiliar to folks in Commercial Real Estate Finance (CREF). As depicted below, with many quickly moving, independent stakeholders responsible for sharing a significant number of files containing critical information, getting deals “off the street” quickly can be difficult.

Figure 1 – CREF stakeholder collaboration can be challenging

Consider the challenges facing First Mortgage, a fictitious lender offering financing for multiple asset classes (multifamily, office, industrial, senior housing, etc.) via multiple products and services (Fannie, Freddie, FHA, Bridge, etc.) The volume and diversity of its business requires expertise that is provided by both internal and external stakeholders. Without the ability to onboard partners easily, monitor and control collaborative file sharing and integrate content received from partners into backend systems and business process workflows, First Mortgage is burdened with inefficiencies that degrade profitability and make it difficult to compete in the digital age.

The good news is…cloud-based technologies are a great equalizer and although CREFs are historically slow to adopt enabling technology, First Mortgage is well positioned to realize the benefits of digital transformation and technologies such as Thru’s MFTaaS solution set, the first cloud-native managed file transfer (MFT) solution.

More good news: With Thru, First Mortgage can transform into a seamless business ecosystem and start realizing the following benefits very quickly:

Cloud-Native SaaS

- Scalable – A cloud-native platform eliminates implementation and maintenance costs and provides infinitely scalable support for an unlimited number of partner stakeholders.

- Flexible – Built to stand alone, expose APIs for custom integration and/or connect to leading integration platforms via Thru’s connectors—enabling enterprises of all sizes and complexity to benefit from one enterprise-wide, file transfer platform.

- Pricing – Pricing tiers are usage-based.

Speed

- Timely availability of critical deal information to all stakeholders at every step through the process.

- Quickly onboard partners; add endpoints and process subscriptions via an easy-to-use web-based interface.

- Supports integration to improve automation (alerts, notifications, process events, etc.)—enabling lenders to execute quickly.

Control

- “Single Pane of Glass” visibility into collaborative file exchange activity across the entire ecosystem.

- Monitoring and control improves the completeness and accuracy of deal information through business processes—eliminating redundancy, supporting “one touch” processing and improving quality.

- Detailed activity tracking supports reporting, alerts and notifications.

If you would like to learn more how Thru can simplify file exchange workflows for your organization, please contact us.